She will be paying RM 31300 in income tax for YA 2021 and its calculation is. Unlike a corporation a sole proprietorship is not a separate entity from the person who owns it.

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

Estimate your Gross Annual Income.

. No corporate tax imposed- As the sole proprietorship is not a separate legal entity from the owner it will not get taxed as such. Here the liability is undertaken by the. Normally those tax not allowable or 50 allowable will be add back when doing tax computation.

With our Malaysia corporate income tax calculator you will be able to get quick tax calculation adjustments that help you to estimate and accurately forecast your tax payable amounts. Owner of a sole proprietorship business is liable to all the losses and debts made in the company. This is because of the following laws set in place.

To start with first lets calculate Janets income tax payment for YA 2021 if she succeeds in attaining as much as RM 250000 in PBT as a sole proprietor in YA 2021. 25 percent 24 percent from Year of Assessment YA 2016 Special tax rates apply for companies resident in Malaysia with an ordinary paid-up share capital of MYR 25 million and. On the First 5000 Next 15000.

Full ownership- A sole proprietorship is owned 100 by a single person. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. Tax rate Tax RM 0 5000.

In order to become a taxpayer you must first register with the IRS if eligible Create a File Registration Form To obtain a copy of the Income Tax Return Form from the LHNDM Branch that is closest to you if the form does not reach on. Tax computation for sole proprietor in Malaysia freelancersself-employed. So you can still book RM1000 as entertainment expenses.

The system is thus based on the taxpayers ability to pay. Devis tax computation from rental source for the year of assessment 2010 is as follows. Accommodation fees on a tourist accommodation premises registered with the Ministry of Tourism Arts and Culture Malaysia.

But during tax computation RM500 will be. Taxes for Year of Assessment 2021 should be filed by 30 April 2022. However the profits are all enjoyed by the single owner too.

RM Gross rental income 100000. I have a few questions which I hope some of the experts out there can help to answer. Our calculation assumes your salary is the same for 2020 and 2021.

First comes the liability sector of these two business types. If you have a business even small scale or side hustles alongside main job you MUST register it as a company if you want to claim business-related expenses. I have just embarked on a sole proprietor business in Malaysia.

If Janet Remains a Sole Proprietor. As such the owner receives all profits and makes all executive decisions for the business. On the First 2500.

How To File Income Tax For Sole Proprietorship Malaysia. TaxRM 0 - 5000. Who had a sole proprietorship business of trading personal computers.

First 70000 Next 30000 21. Basically this means you are the business and the business is you. First 50000 Next 20000 13.

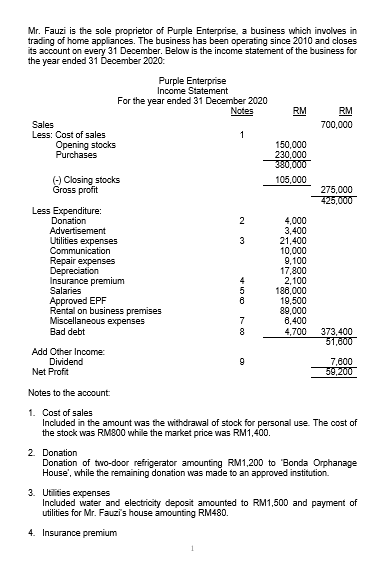

Computation of Partnership Income For tax purposes every partnership would be treated as if it is a sole proprietorship business. Profits and Liability. Question 08022022 By Stephanie Jordan Blog.

On the First 70000 Next 30000. First 5000 Next 15000 1. In the case of sole proprietorship business chargeable income is his or her individual income.

Banjaran Pendapatan Cukai Pengiraan RM Kadar Cukai RM. On 11 October 2019 YB Lim Guan Eng the Minister of Finance unveiled the Malaysian Budget 2020. A sole proprietorship is basically the simplest form of business ownership there is and in Malaysia it is governed by the Registration of Businesses Act 1956.

There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make. First 35000 Next 15000 8. The tax rate for sole proprietorship or partnership will follow the tax rate of an individual.

First 20000 Next 15000 3. On the First 35000 Next 15000. Malaysia Corporate Income Tax Calculator for YA 2020 and After.

Additional deduction of MYR 1000 for YA 2020 to 2023 increased maximum to MYR 3000. Whereas in partnership the chargeable income is divided among the partners as an individual. In Malaysia income derived from letting of real properties is taxable under paragraph 4 a business income or 4 d Rental income of the Income Tax Act 1967.

On the First 20000 Next 15000. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. The gross income and adjusted income of the partnership in respect of each partnership source would be computed as though the partnership was a.

Now I mentioned earlier that business owners must declare business profit as income which is your sales MINUS expenses. B He is resident in Malaysia because he is physically present in Malaysia for a period of 182 days or more in 2010. This means that low-income earners are imposed with a lower tax rate compared to those with a higher income.

On the First 50000 Next 20000. On the other hand SDN BHD comes with limited liabilities. Special relief for domestic travelling expenses until YA 2022.

Accounting Equation Sole Proprietor S Transactions Accountingcoach

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

Sample Balance Sheet And Income Statement For Small Business

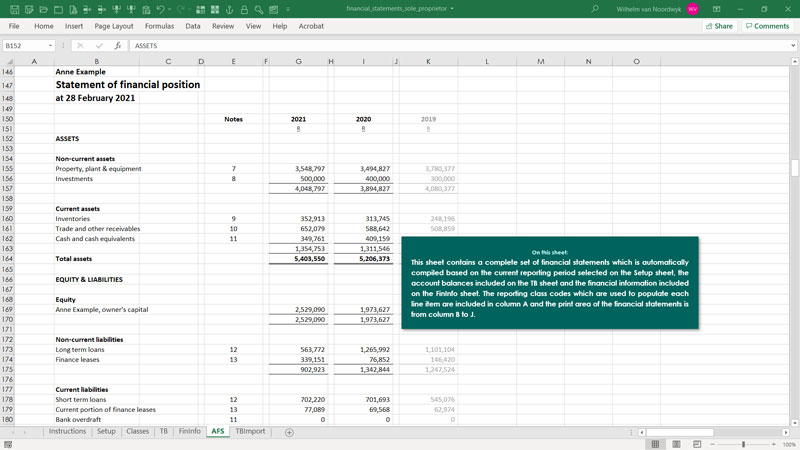

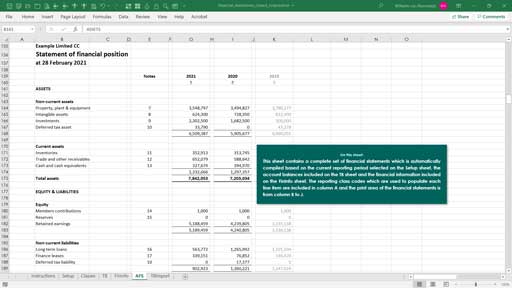

Sole Proprietor Financial Statements Excel Skills

Accounting Equation Sole Proprietor S Transactions Accountingcoach

Accounting Equation Sole Proprietor S Transactions Accountingcoach

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

Sole Proprietor Financial Statements Excel Skills

Ts Grewal Accountancy Class 11 Solutions Chapter 15 Financial Statements Of Sole Proprietorship Ncert Solut Financial Statement Sole Proprietorship Financial

Taxplanning So You Want To Start Your Own Business The Edge Markets

7 Rm 68 000 Adjusted Income Capital Allowances For Chegg Com

Simple Balance Sheet For Sole Proprietorship Or Partnership Pdf Balance Sheet Equity Finance

Mr Fauzi Is The Sole Proprietor Of Purple Chegg Com

How To Invoice As A Sole Trader Invoicing Guide For Beginners

Simple Balance Sheet For Sole Proprietorship Or Partnership Pdf Balance Sheet Equity Finance

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

Sole Proprietorship Returns Tax Year 2015 Document Gale Academic Onefile

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net